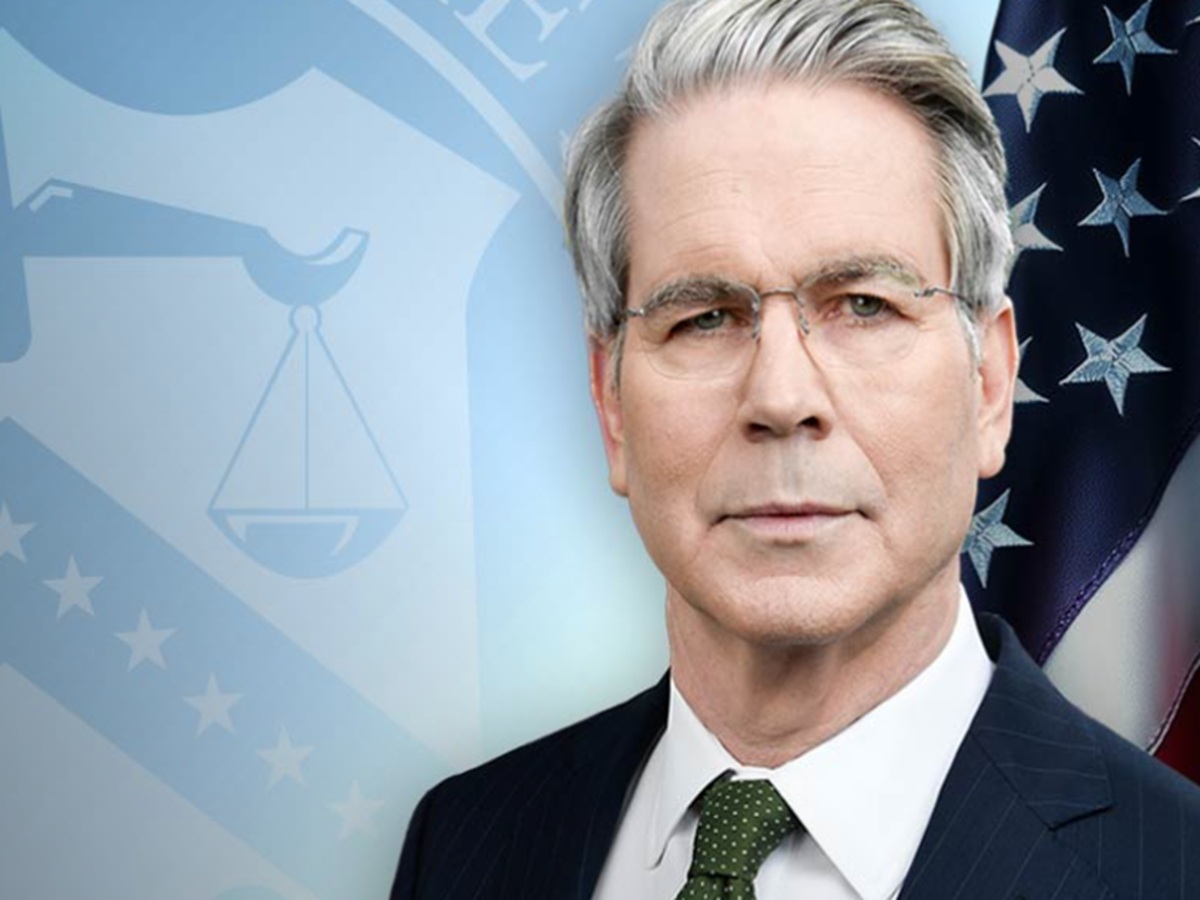

Trump's Economic Policies Stir Market Turmoil, Bessent Seen as Key Stabilizer

President Trump’s aggressive economic policies have shaken global financial markets. Foreign media report that the market urgently needs a key figure to stabilize the situation, and Treasury Secretary Scott Bessent, with a hedge fund background, is viewed as the 'hope of the village' tasked with keeping Trump's policies in check.

Bessent is one of the officials closest to Trump who understands market dynamics the best. He previously worked under the financial giant Soros and participated in the historic 'shorting of the pound' in 1992. Whenever Trump’s policies have triggered market turmoil, Bessent stepped in multiple times to stabilize the situation, for instance, by facilitating the temporary suspension of tariffs and preventing Trump from interfering with the independence of the Federal Reserve, effectively calming fears across U.S. stock, currency, and bond markets.

While the market hopes that Bessent's expertise can balance Trump's impulsive decisions, pessimists argue that this is merely a drop in the bucket, unable to address the U.S.’s long-standing fiscal deficit and debt issues, nor eliminate Trump’s unpredictability. Should Bessent be ousted from Trump’s inner circle, global investors would need to be cautious, as a new wave of risk may be on the horizon.