Federal Reserve Holds Interest Rates Steady: How Should Investors Navigate the Market Rebound?

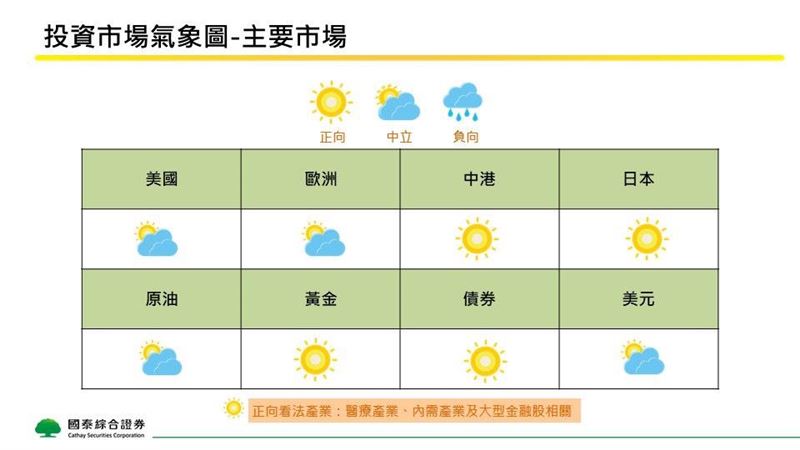

The Federal Reserve held its benchmark interest rate unchanged in its latest meeting, reflecting a cautious outlook on inflation and the current economic landscape. Amid ongoing tariff negotiations and a recent consensus for a 90-day 'ceasefire' on tariffs between the U.S. and China, market optimism has surged, resulting in a rapid stock market rebound. Cathay Securities suggests investors pay close attention to bonds and large financial stocks to mitigate market uncertainties.

As U.S. debt continues to rise along with interest expenses, Moody's recently lowered the U.S. sovereign credit rating to Aa1, which may boost demand for high-rated corporate bonds. Cathay recommends that investors consider increasing their allocation towards higher-rated bonds and focus on defensive bond sectors such as utilities, healthcare, telecommunications, and defense industries, which are expected to have stable cash flows and lower default risk during economic downturns.

Due to the absence of actual sanctions, Japan's stock market did not face panic selling and is benefiting from favorable corporate earnings forecasts. Cathay advises investors to focus on Japan's financial sector in the short term, particularly mid-to-large banks that are likely to perform strongly. In the Chinese and Hong Kong markets, the ongoing tariff negotiation period along with favorable policies from the Chinese government provides a bullish environment for Hong Kong stocks.

The uncertainty surrounding political and trade policies will continue to be a key factor influencing investment, thus, investors are encouraged to adopt a cautious strategy with a focus on diversified asset allocation and risk management to adapt to the changing global market environment.