Taiwan Stock Outlook: Trade Talks Boost US Stocks, Hope for Breakthrough from Volatility Zone

According to reports from the finance center, positive news from the US-China trade negotiations has driven all four major US indices to rise, suggesting that the Taiwan stock market may break out of its recent volatility zone when trading resumes next week. With the trade tensions between China and the US easing and robust US non-farm payroll data providing a dual boost, US stocks surged, leading to a 94-point increase in the Taiwan Futures market. TSMC futures also saw a slight increase of 3 TWD.

Reports indicate that the US added 139,000 jobs in May, far exceeding market expectations, while the unemployment rate remained unchanged at 4.2%, indicating resilience in the labor market despite some downward revisions of previous months' data. Moreover, President Trump has criticized the Federal Reserve's monetary policy, expressing concerns that rate hikes are occurring too slowly, which has rekindled market expectations for a rate cut.

Next Monday, US and Chinese trade representatives are set to meet in London, fueling positive market sentiment regarding the negotiations. Benefiting from this momentum, US stocks closed strongly on Thursday, with the Dow Jones Industrial Average surging by 443 points and breaking the 6000-point mark for the first time; the S&P 500 rose by 1.03%, and the NASDAQ gained 1.20%. The influx of capital into risk assets clearly favored technology and large-cap stocks. In the overnight session, Taiwan Futures followed suit, rising 94 points to close at 21,660 points, reflecting a strengthened bullish sentiment among investors, although there was a slight decline of 0.8 billion TWD in the financing balance, indicating a more cautious approach from retail traders.

It is noteworthy that there was a net selling of 12.3 billion TWD by the three institutional investors, with foreign investors unloading 13.67 billion TWD in a single day, adding pressure to the market. However, investment trusts went against the trend with a net purchase of 3.73 billion TWD, while proprietary trading remained limited. Therefore, while institutions exhibited divergent operations, it remains essential to monitor international conditions and the movements of key stocks.

From a technical perspective, the weighted index fell 13 points to close at 21,660 points and continues to consolidate within a high range. If it can effectively break through the 21,700-point resistance barrier next week, it may challenge previous highs; conversely, if it opens high and trades lower, the focus should shift to whether the monthly support can hold. Short-term attention should be paid to electronic blue chips and stocks benefiting from the US-China trade negotiation theme; however, before the resolution of international bad news, cautious trading within the range is advised, waiting for strong volume and improved sentiment to add positions accordingly.

Recent News

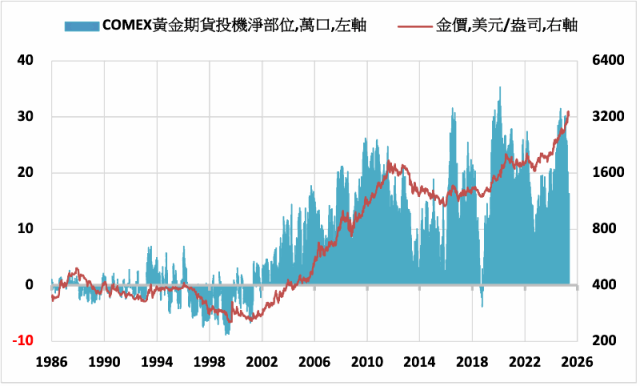

COMEX Gold Rises 2.2% Boosted by Safe-Haven Demand

- 26 May, 2025