COMEX Gold Rises 2.2% Boosted by Safe-Haven Demand

On May 23, COMEX June gold futures closed up $70.8, or 2.2%, at $3,365.8 per ounce, while the U.S. dollar index fell 0.8%. July silver futures also rose 1.2%, reaching $33.609 per ounce. According to independent metal trader Tai Wong, the market sentiment preceding the Memorial Day long weekend was dampened by Trump's threat to impose a 50% tariff on EU goods, which turned out to be good news for the gold market.

The world’s largest gold ETF, SPDR Gold Shares (GLD), saw its holdings increase by 2.58 tons to 922.46 tons. Meanwhile, the largest silver ETF, iShares Silver Trust (SLV), reported a rise in silver holdings to 14,217.50 tons.

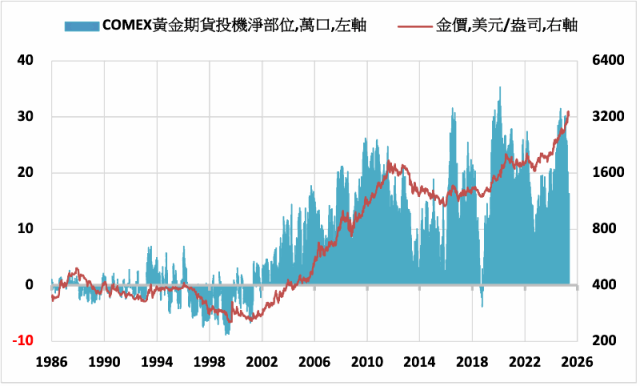

VanEck’s report indicates that gold is currently in a new consolidation phase, seemingly establishing strong support above $3,000 per ounce. Despite the substantial increase in gold prices over the past two years, the overall investment market remains largely indifferent to gold, with only about 1% of global portfolio assets allocated to gold. They suggest strategically allocating about 5% of assets to gold, noting that current investment demand remains well below historical peaks.

Analysts predict that if investors truly return to the gold market, in conjunction with central banks' ongoing strong buying, gold prices could surge significantly, potentially reaching $5,000 in five years. The report emphasized that gold has historically outperformed traditional asset classes over the long term.