Pre-Market Insights: Turbulence in the US Market and Appreciation of TWD

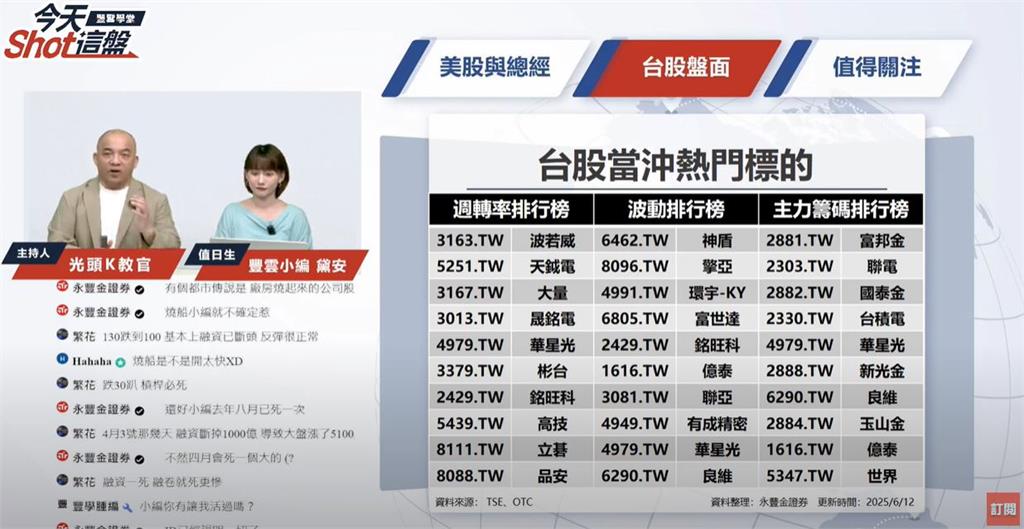

The fluctuations in the US market and currency trends prompt attention to whether Taiwan's stock market can surpass NT$320 billion in transaction volume before opening.

On the 26th, Taiwan stocks experienced a minor pullback, with the index dropping 115.67 points, a decline of -0.53%, closing at 21,536.57 points, and a transaction volume of NT$295.799 billion. According to Du Xinpei, manager of PGIM Prudential's small and mid-cap fund, the recent Computex event in Taipei has drawn market focus on the outlook for AI from tech giants. NVIDIA’s CEO, Jensen Huang, remarked that AI is becoming integral to everything, and NVIDIA will provide the Blackwell core system architecture and NVLink high-speed interconnect technology, teaming up with foundry leaders to establish a large-scale AI supercomputer, laying the cornerstone of Taiwan's AI infrastructure.

Du believes that AI remains a central theme for mid-to-long-term investment in Taiwan stocks. The strong capital expenditure outlook released by US cloud service providers for 2025 illustrates the persistent growth trend of AI. Notably, Meta Platforms has increased its capital expenditure guidance by 9%, with Q1 capital expenditures rising to US$13.7 billion, and the annual forecast adjusted to between US$64 billion and US$72 billion. Microsoft has reported a 53% year-on-year increase in capital expenditure while maintaining its outlook for the second half; Google’s Q1 capital expenditures grew 43% year-on-year to US$17.2 billion; Amazon saw a 68% increase in Q1 capital expenditure, reaching US$25 billion mainly for AWS investments.

Overall, the capital expenditure of the four major US cloud service providers is expected to increase by 37% in 2025, continuing a positive trend for AI development and investment. As we approach the end of Q2, Du has stated that despite better-than-expected financial results from Taiwan stocks in Q1, the equal tariff effects may disrupt order rhythms in Q2, and the appreciation of currency may lead to downward adjustments in earnings forecasts for the second half. According to brokerage reports, the revised projected EPS growth rate for Taiwan stocks is now 16.8%, slightly lower than the previous estimate of 19.2%, highlighting strong earnings growth momentum for Taiwanese companies.

Regarding the recent trends in Taiwan stocks, Du noted that with this rebound nearing pressure zones, the upper half-year and annual line pressures are imminent. If transaction amounts can exceed NT$320 billion, it will be beneficial for the index to challenge these pressure zones; otherwise, there may still be pressures to withdraw and consolidate.

Sanlih News Network reminds you: The content is for reference only; investors should carefully evaluate risks when making decisions and take responsibility for investment results.