Wanhai Stock Rises 5% After Fire Incident, Is the Main Force Buying or Selling?

Wanhai Shipping Co. saw its stock price unexpectedly rise 5% after a recent fire incident. This has sparked widespread discussions in the market regarding whether the main force is buying or selling. Today's pre-market analysis will focus on trends in U.S. stocks and Taiwanese stocks, as well as popular day trading stocks.

Key points for today (the 12th) regarding the Taiwanese stock market:

- The weighted index's daily chart indicates that the market is still in a tug-of-war between bulls and bears, with a lack of significant breakthrough momentum in the short term.

- Foreign futures net short positions have expanded to 35,730 contracts, creating a bearish atmosphere.

- The cumulative buying power of the three major institutions has weakened, with only a few individual stocks favored.

Despite the recent fire incident, Wanhai's stock price has risen, drawing significant market attention. Possible reasons include:

- The incident occurred several days ago and has not affected shipping schedules or actual operations.

- Market players may be speculating on the incident as a topic, along with recent US-China Geneva agreements easing tariff pressures, stimulating a rise in the shipping sector.

- Evergreen has announced a dividend of 32.5 TWD, with a yield of 13.4%, boosting overall buying interest in the shipping sector.

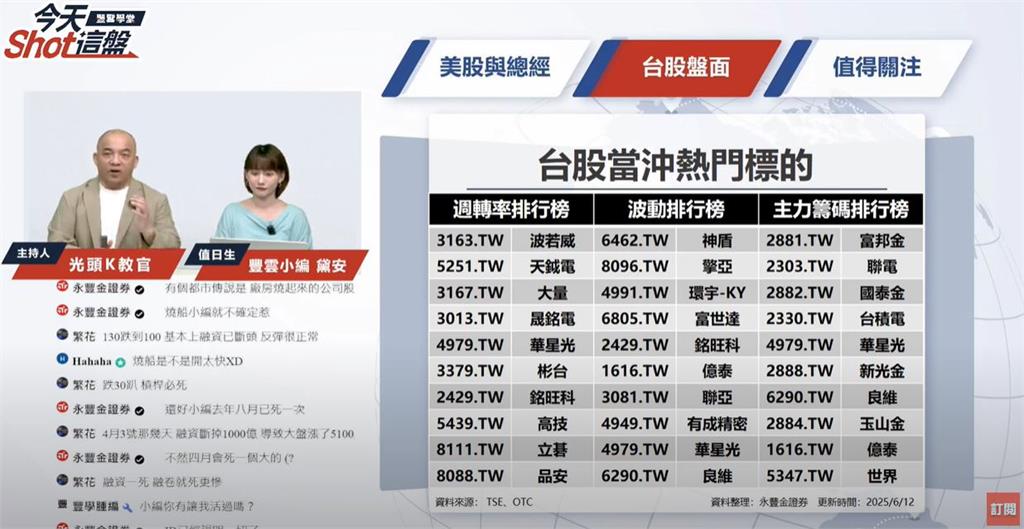

Observations on popular day trading stocks:

- Wanhai currently does not make the list of the top five day trading stocks, but overall market risk remains high.

- Stocks such as Hwa Hsing and Liang Wei, known for high turnover and volatility, continue to be the main battlefields for short-term capital.

《Minibet News Network》 warns investors that the content is for reference only, and they should carefully assess risks and take responsibility for their investment decisions.