Taiwan Dollar Surges Past 30 Mark, Exporters Rush to Sell Amid Central Bank Dilemma

Since April, the Taiwan dollar has appreciated over 11%. It broke the 30 mark on Monday, reaching a peak of 29.850, up nearly 4% for the day. Exporters are rushing to sell to protect themselves, creating volatility in exchange rates and putting the central bank in a difficult position regarding intervention.

According to reports, the Taiwan dollar has strengthened other Asian currencies, buoyed by market expectations that the worst-case scenario for US-China tariff negotiations may have passed. Investors are increasing their risk appetite, leading to a surge of capital into Asian markets. However, financial market insiders claim that this surge is primarily driven by the panic selling of exporters rather than positive expectations regarding the negotiation progress.

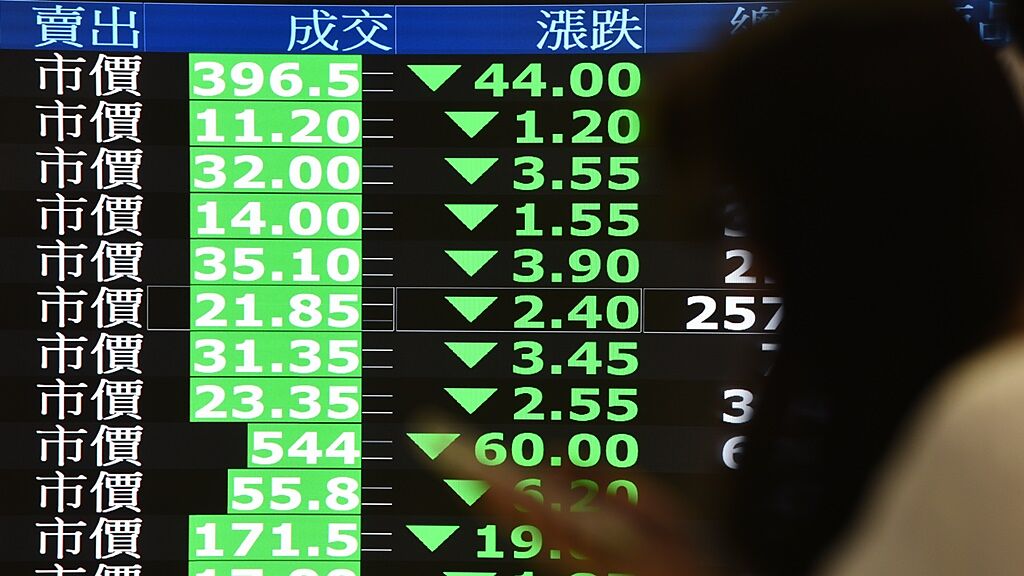

As the Taiwan dollar continues to rise, financial markets are feeling the ripple effects, impacting stock performance. The Taiwan stock market saw a decline, particularly with stock prices of major companies like TSMC and Foxconn. Analysts suggest that the appreciation of the Taiwan dollar is not only affecting exporters but also exerting pressure on financial markets.

The central bank faces a difficult decision on whether to intervene. Intervening could attract accusations of currency manipulation from the United States, while remaining passive could significantly harm export competitiveness and market stability.