Trump's Tariffs Hit US GDP; Major Indices Plummet

The US economy unexpectedly turned negative in the first quarter, compounded by market concerns about President Trump's new tariffs, shaking investor confidence. On Wednesday (30th), all four major US stock indices plunged during morning trading, with significant losses. As of 10:10 AM Eastern Time, the Dow Jones Industrial Average fell by 612.48 points to 39,915.14; the Nasdaq tumbled 403.43 points to 17,057.88; the S&P 500 dropped 100.65 points to 5,460.18; and the Philadelphia Semiconductor Index also plummeted by 93.41 points to 4,103.34.

According to preliminary estimates from the US Department of Commerce, GDP adjusted for inflation contracted at an annualized rate of 0.3% in Q1, marking the first recession since 2022, and far below the average growth rate of 3% over the past two years. Economic analysis indicates that the primary reasons were weak consumer spending and soaring imports, with net exports dragging economic growth down nearly five percentage points.

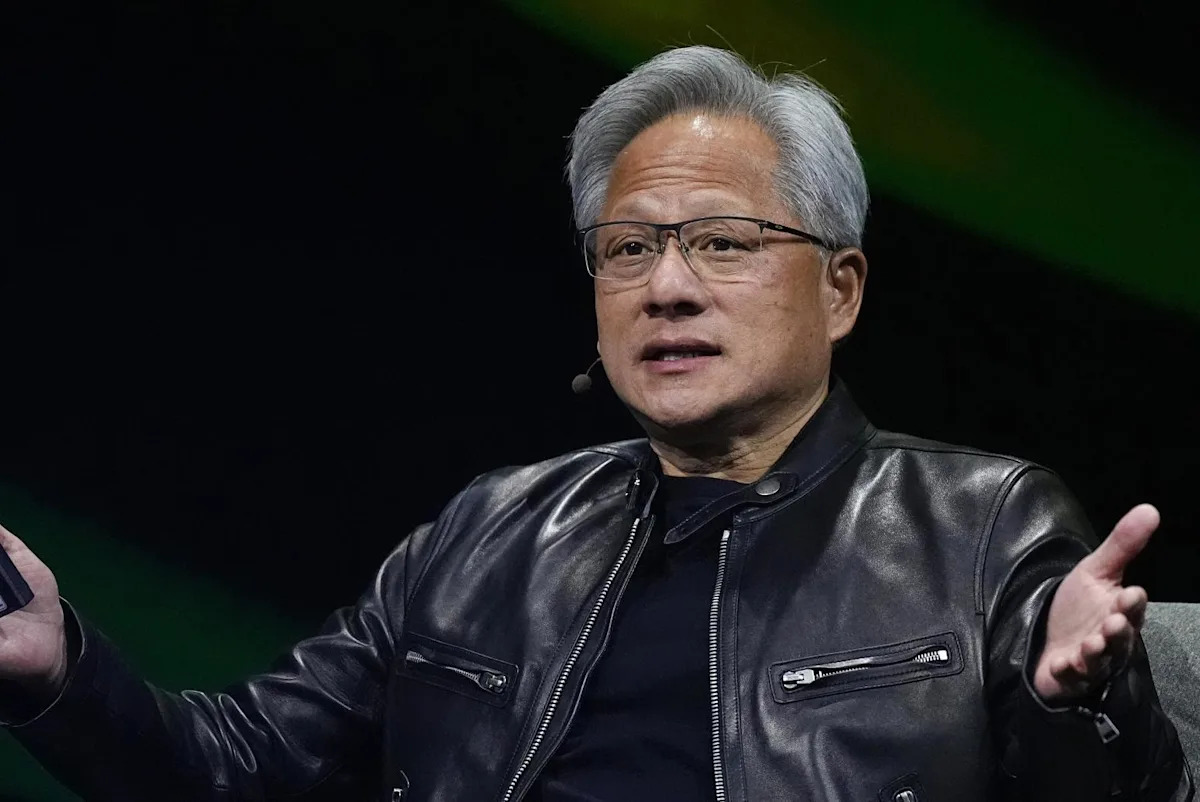

Technology and semiconductor stocks were similarly under pressure, with TSMC ADR down 1.05% to $162.7; Nvidia plummeting 3.72% to $105.14; Intel falling 3.20% to $19.69; and AMD dropping 2.67% to $93.5.

Analysts noted that US companies are concerned about the Trump administration reigniting a trade war, leading them to import in advance, resulting in a 'pull-ahead effect' on GDP. Coupled with persistent inflation, these dual headwinds have led to heightened risk aversion in the market, placing significant pressure on US stocks.