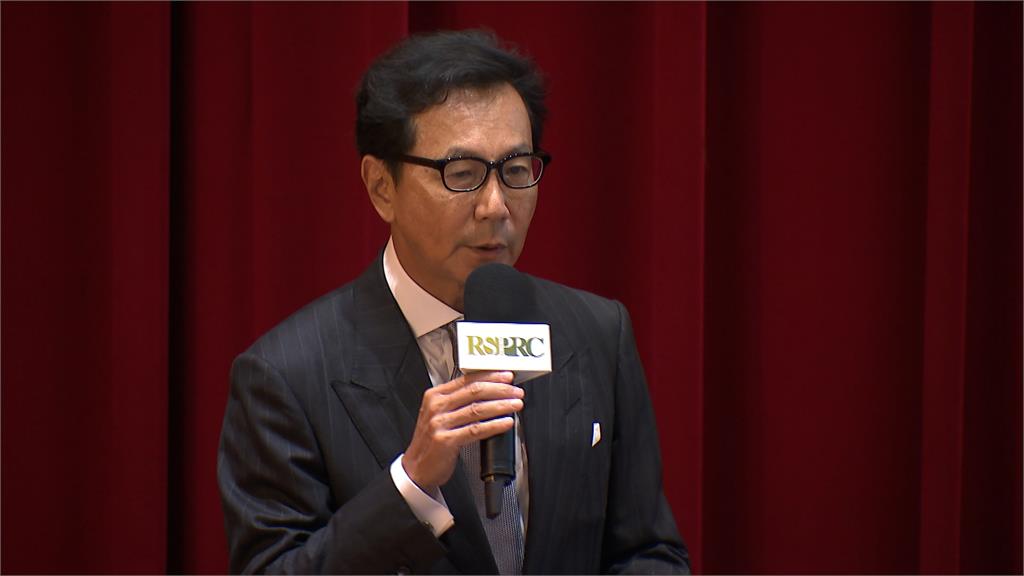

ASE Announces Q1 Revenue Exceeding 148.1 Billion TWD, 11% Year-over-Year Growth, EPS at 1.75 TWD

ASE Technology Holding Co. held its earnings conference call on April 30 to announce the Q1 2025 operational report. The first quarter revenue reached 148.15 billion TWD, marking a year-over-year increase of 11.56%, achieving a record high for the same period. However, it represented an 8.7% decrease compared to the previous quarter.

The net profit attributable to the parent company was 7.554 billion TWD, resulting in earnings per share of 1.75 TWD, with a quarter-over-quarter decrease of 22% but a year-over-year increase of 33%. The revenue from semiconductor packaging and testing reached 86.668 billion TWD, decreasing 1.9% from the previous quarter but increasing 17.3% compared to the previous year; its application breakdown is 48% telecommunications, 22% computing, and 30% automotive and consumer electronics combined.

Meanwhile, revenue from electronic manufacturing services amounted to 62.295 billion TWD, representing a year-over-year growth of 4.9% but a quarter-over-quarter decrease of 16.8%; the breakdown by application includes 33% telecommunications, 11% computing, 31% consumer electronics, 13% industrial use, 10% automotive electronics, and 2% others.

According to the company's current business assessment and currency assumptions, ASE provided an optimistic outlook for Q2 performance. When denominated in TWD, the semiconductor testing business is expected to see a quarter-over-quarter growth of 9% to 11%, while the gross profit margin is anticipated to increase by 140 to 180 basis points compared to the prior quarter. Conversely, electronic manufacturing services are projected to decline by 10% year-over-year, with an expected decrease of 100 basis points in operational profit margin.

ASE previously stated that the strong growth momentum from advanced packaging and testing businesses would enable its semiconductor testing operations to outpace the logic semiconductor market, with revenue from advanced packaging and testing expected to rise by 1 billion USD compared to 2024, contributing a 10% growth rate to the packaging business, while standard operations are expected to grow in the mid-to-high single digits.