US Begins Rate Cut Cycle: Effective Strategies for Euro, Yen, and US Treasury Investments

According to Li Qizhan, the US has finally commenced a rate cut cycle in line with market expectations during the recent interest rate meeting, cutting rates by two basis points, exceeding market predictions. This move has boosted investor confidence, suggesting that this preventive rate cut can support economic recovery, propelling the US stock market higher while the dollar has shown a downward trend. Meanwhile, the rise of US Treasuries has temporarily halted. So, how should we allocate the Euro, Yen, and US Treasuries?

Challenges for the Euro's Fundamentals

Although the Euro has already initiated rate cuts, the market's focus remains on the dollar, which limits the upward movement of the Euro. If the European Central Bank accelerates rate cuts or if economic data shows clear signs of deterioration, the Euro may depreciate. It is essential to monitor European GDP and CPI performances; a further drop in inflation might prompt the European Central Bank to cut rates again. Investors looking to invest or hedge can consider using Euro futures from CME as a low-cost, highly liquid trading tool.

Japanese Yen's Consolidation Phase

The Bank of Japan has decided to maintain interest rates, halting its rate hike cycle to prevent excessive appreciation of the Yen, which would negatively impact the Japanese economy and stock market. Thus, the Yen is likely to remain in a consolidation phase while the dynamic shifts to the dollar, indicating a weak dollar might appreciate the Yen while a dollar rebound may lead to Yen depreciation. Interested investors can explore trading in Yen futures from CME as a way to capitalize on this volatility.

Profit-Catching Pressure in US Treasuries

Ahead of the US rate decision, market reports suggested a two-basis point cut, leading long-term Treasury yields to decline. However, following the actual rate cut announcement, profit-taking pressures emerged. Short-term Treasuries, like the two-year note, maintained low yields, revealing a distinct improvement in the yield curve inversion. This situation arises from overly pessimistic market sentiment leading to heavy investment in long-term Treasuries. The Federal Reserve only slightly adjusted GDP forecasts and increased unemployment figures, not signaling an abrupt opening for rapid rate cuts. If economic data remains stable, the rate cuts could be more preventive than indicative of recession, making it tough for ten-year Treasury yields to dip below 3% before year-end. Investors believing that two-year Treasury yields will approach 3% might consider engaging in spread trading, buying two-year notes while selling ten-year Treasuries.

For those new to spread trading, CME offers instructional videos to understand the implied basis points and calculate the correct spread ratio. For those who view the current adjustment in ten-year Treasuries as temporary, it may be an opportune moment to strategize asset allocation by buying ten-year and two-year Treasuries to mitigate asset volatility. For any investment or hedging needs, consider CME's two-year and ten-year Treasury futures as tools to participate swiftly in the market.

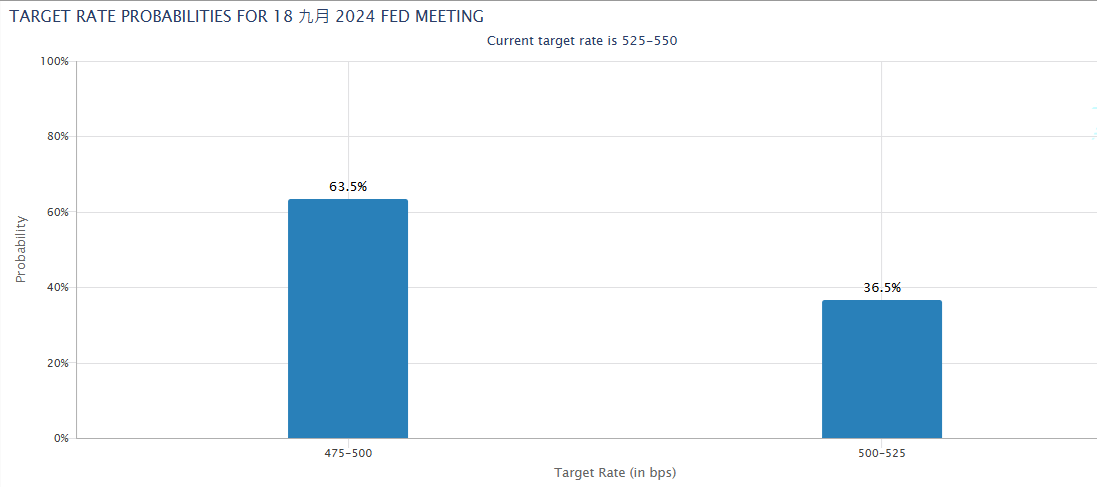

Want to understand how the interest rate futures market views the likelihood of rate cuts? CME's free FedWatch tool provides insights into potential rate cut ranges and probabilities for upcoming meetings, helping you grasp the latest market trends and directions.

CME is a leading and diversified derivatives trading market, effectively managing risk for the global business community.