With Rate Cuts Approaching, Will Yield Inversion Come to an End? Four Spread Trading Opportunities Emerge

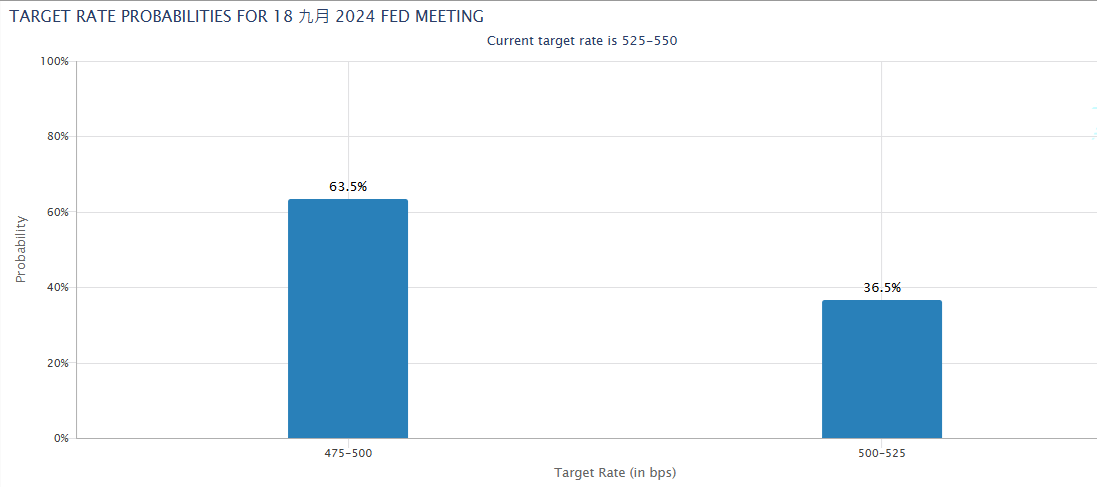

As rate cuts draw near, there is growing optimism about the potential end of the yield inversion. Analysts note that not only is this situation likely to improve, but four spread trading opportunities have also emerged that investors should consider.

The spread trading opportunities include:- Changes in interest rate expectations

- Relative value between bonds and stocks

- Yield differences in bonds with varying maturities

- Market reaction trends following economic data releases

Investors should closely monitor upcoming economic indicators, as these may impact market sentiment and the yield curve.