A Single Trump Post Sends Gold Prices Soaring! Expert Analysis on Buying and Selling Gold

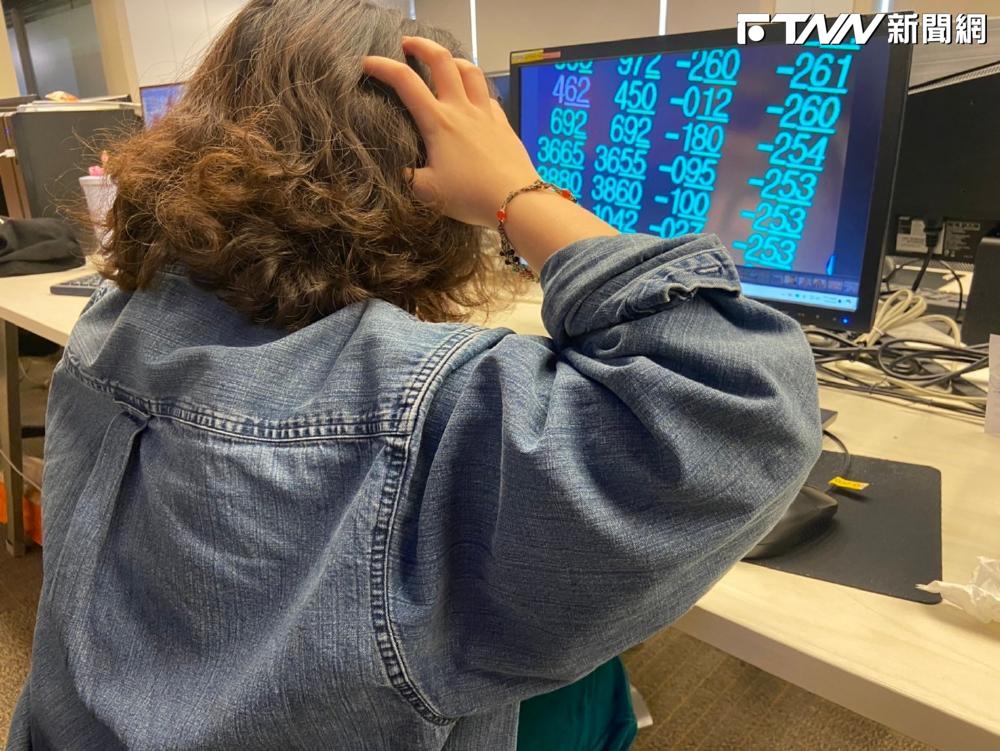

“Without Trump, there would be no gold prices today!” Gold has shown impressive performance this year, but often spikes dramatically due to a single post by US President Trump on X. How should investors respond? Should those without gold buy ETFs? These questions arise continuously, warranting a thorough analysis of potential investment risks.

In an interview, Yang Tianli, manager of the precious metals department at Taiwan Bank, noted that gold prices have increased by about 30% this year, with intraday prices even surpassing $3,500 per ounce, marking the largest quarterly increase since Q3 1986. In just the first quarter of this year, gold prices reached new highs 18 times, which is astonishing. He emphasized that no one dares to bet against gold right now, especially as market sentiment has shifted from safe-haven properties to panic, influenced by Trump's recent statements.

In a global context dominated by multipolarity, gold has become a safe haven, with many countries raising gold reserves to diversify risks, as exemplified by Russia. Currently, gold accounts for 32% of Russia's foreign currency reserves, significantly higher than the global average of about 15%.

However, the current risk premium embedded in gold prices is alarmingly high, raising concerns among experts. Furthermore, the market's supply and demand dynamics indicate that, while physical demand continues to support gold prices, the potential for corrections in the future may be substantial. Even with Goldman Sachs raising their gold price targets, any small shift in the market could trigger significant reactions given the current level of divergence.

Yang Tianli suggests that investors looking to diversify risk should consider allocating gold, but those aiming for short-term trading should proceed cautiously, as market sentiments can fluctuate dramatically based on a single post from Trump.