Taiwan Stocks Drop 300 Points Post-Duanwu, Expert Identifies True Cause

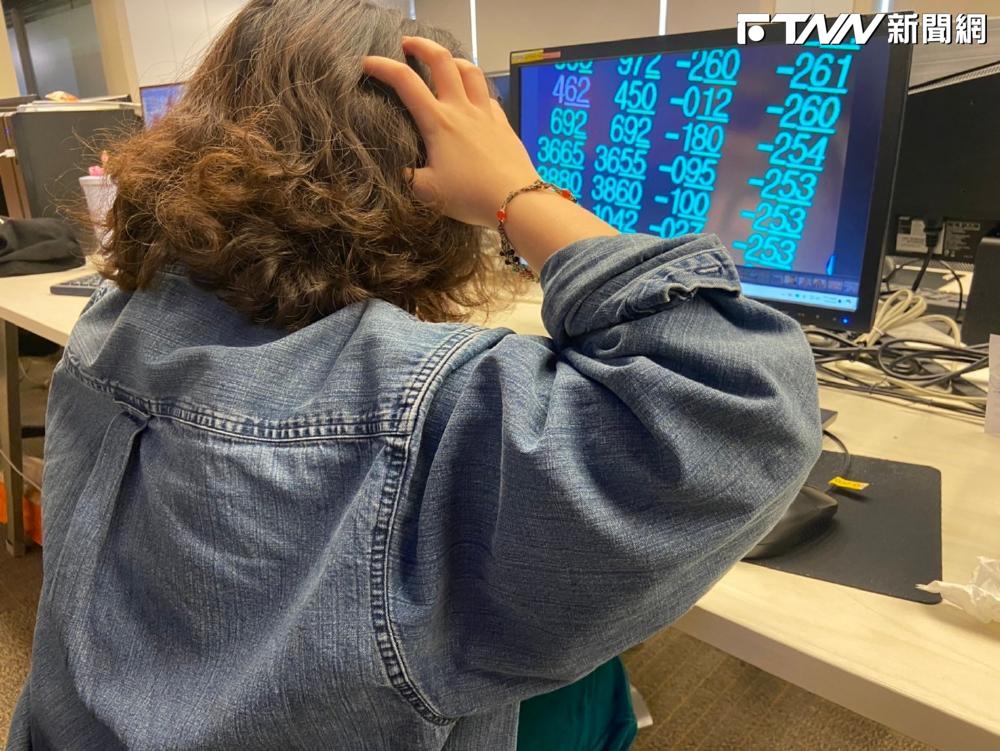

On the first trading day after the Duanwu holiday, Taiwan's stock market saw a significant drop, opening lower and falling over 300 points at one point, reaching a low of 21026.88 points, and finally closing at 21002.71 points, reflecting a daily drop of 1.61%, totaling 344.59 points. This has raised market alerts regarding the "Duanwu market shift".

However, financial writer Te-Chiang indicated that the main reason for this heavy fall is not related to U.S. President Trump's political statements, but rather the considerable increase in "foreign investors' short positions". Last week, foreign investors continuously increased their futures short positions, with the last trading day before the holiday seeing their net short positions surge past 47,000 contracts, reaching the sixth-highest level in history.

Te-Chiang warns that this data is not an isolated incident but a critical signal, as many seasoned investors regard a short position exceeding 40,000 contracts as an indicator of a potential sharp drop in Taiwan stocks. Historical data shows when foreign short positions rise sharply, the probability of a drop in Taiwan stocks the next day reaches 70%, with an average decline of around 2.33%. Even within five trading days, the probability of a decrease is over 60%. This indicates that once foreign investors heavily increase their short positions, market pressure will rapidly intensify.

Furthermore, Te-Chiang points out that foreign investors do not rely solely on futures positions but also utilize large-cap stocks for market pressure. Therefore, under the dual advantage of strategy and capital, it is challenging for foreign investors to incur losses, which often leads to difficulties for bullish investors. He emphasizes that while Trump's remarks may frequently affect market sentiment, the short-term trends are still largely determined by changes in capital and overall economic trends. He urges investors to pay attention not only to international developments but also to technical factors and capital momentum in Taiwan stocks to avoid misjudgments, and to stand firm amid turmoil and seize opportunities.