Foreign Investors Optimistic on Semiconductor Stocks Despite Sell-off of TSMC

On October 25, Taiwan's weighted index rose by 393.92 points, closing at 19872.73, a gain of 2.02%, with a trading volume of NT$2880.43 billion. According to statistics from 'Wanggu Network', the top ten stocks with the most sell-offs by eight major public banks today showed that the top seller was financial stock KGI Securities (2883) with 5236 shares sold, followed by Taishin Financial (2887) and UMC (2303) with 3166 and 3126 shares sold respectively. Despite a sell-off of 1281 shares of TSMC, amounting to approximately NT$11.47 billion, foreign investors remain optimistic about future performance, adjusting their target prices upward.

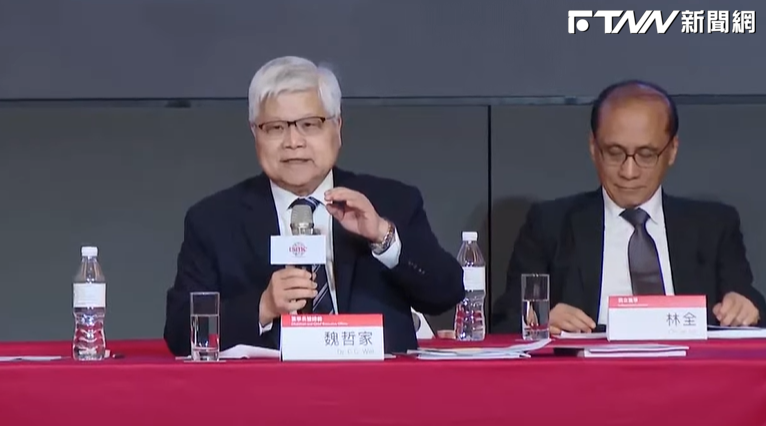

UMC reported Q1 revenue of NT$57.859 billion, down 4.2% quarter-on-quarter but up 5.9% year-on-year, with a gross margin of 26.7% and a net profit of NT$7.777 billion, decreasing by 8.5% quarter-on-quarter and 25.6% year-on-year, resulting in an earnings per share of NT$0.62, a low not seen in 19 quarters. However, multiple foreign securities firms raised their target prices, with Nomura’s target price revised from NT$50 to NT$52; Crédit Agricole revised its target from NT$43 to NT$46; HSBC adjusted from NT$47.8 to NT$49; and Goldman Sachs from NT$39 to NT$44.5.