AI Wave Boosts TSMC Stock Surge! CEO’s Remarks Spark Foreign Buying Frenzy

At TSMC's shareholder meeting on the 3rd, Chairman C.C. Wei presented a series of positive updates, revealing a persistent strong demand for AI chips and an optimistic outlook for revenues over the next 5 to 10 years. This prompted foreign investors to shift their approach, resulting in a rapid buy-over of more than 15,000 shares the following day, ending a three-day trend of selling. The stock price surged by NT$40 to close at NT$990, marking an impressive rise of 4.21%. This spike not only restored TSMC's market valuation to over NT$25 trillion but also propelled the overall Taiwanese stock market up by 491 points to 21,618 points, with a transaction volume reaching NT$404.6 billion, signaling a significant increase in market activity.

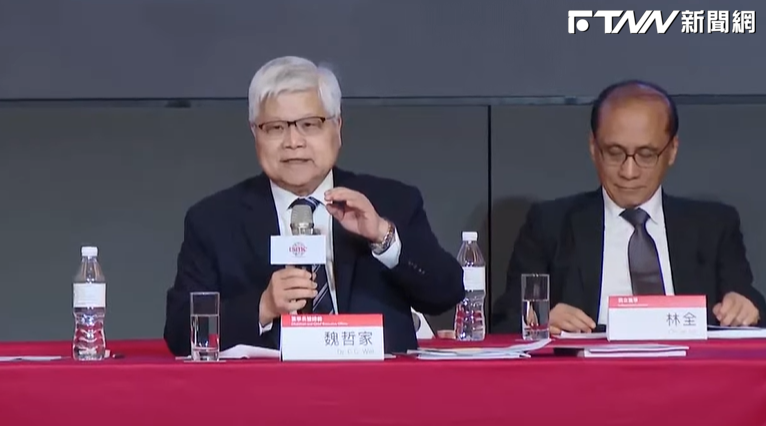

Chairman Wei hosted the shareholder meeting for the first time, and his positive communication greatly excited the market. He highlighted the continuing strong demand for AI chip manufacturing and made a remark saying, “Buying a little more won't hurt,” which investors interpreted as a personal invitation from the chairman, leading to an immediate impact.

According to ETF manager Su Dingyu from Cathay Life, TSMC retains an irreplaceable technological edge in the global foundry market. Coupled with a recent rebound in U.S. stocks and Nvidia reclaiming its title as the world's market cap champion, the entire AI supply chain has reacted positively, with TSMC leading the charge. Despite existing geopolitical and tariff policy risks, investor confidence in AI remains unshaken.

The latest report from U.S. foreign investors has revised TSMC's target price to NT$1,145, also favoring other AI-related suppliers, indicating that the overall industry chain is still in a strong bullish phase. On the other hand, Unified Investment Trust has warned that while the U.S.-China chip tariffs have been temporarily delayed for 90 days, thereby enabling the Taiwan stock market to recover some previously lost ground, the overall market is still in a high volatility period and cautious strategy is advised.

Nevertheless, due to the limited impact of tariffs on the AI sector, it is anticipated that there will be no pressure for early inventory build-up. The revenue growth momentum for related companies is expected to continue. According to CMoney data, since the announcement on April 9 to delay the imposition of reciprocal tariffs by the U.S., the Taiwan stock market has rebounded by over 22%. Notably, AI-related stocks, including electronic components and computer peripherals, have outperformed, with gains exceeding 40%, successfully filling the gap caused by previous policy-induced declines, indicating a clear capital flow back into the technology sector.

As the market remains highly optimistic about AI business opportunities and given TSMC's robust fundamentals, analysts believe that the future performance of the Taiwan stock market will continue to focus on AI and advanced process concept stocks. Investors looking to navigate the turbulence should consider focusing on small to mid-cap electronic stocks with potential themes and growth prospects as a key strategic direction.