Stock Market Opening Soon, Feeling Anxious? Check Out 14 Defensive Stocks Suitable for Small Investors

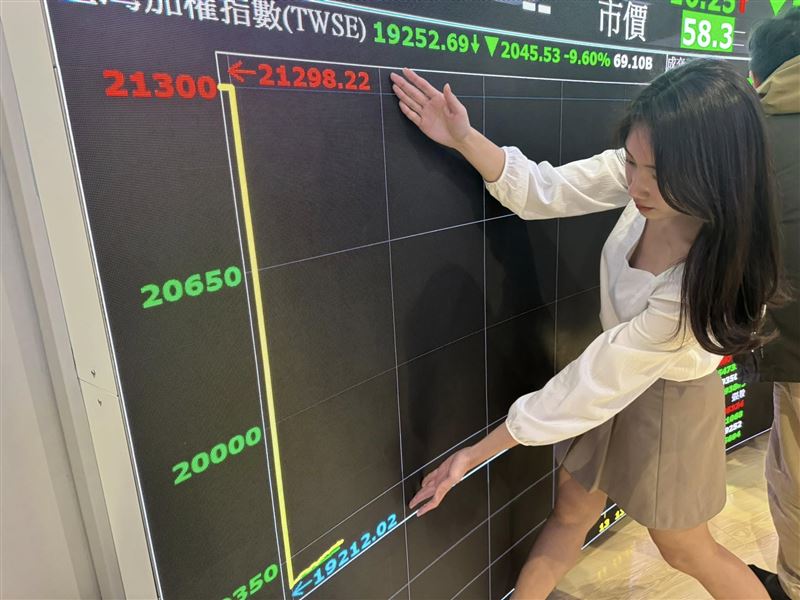

With the recent significant market fluctuations, businesses are hesitant to place orders and small investors are reluctant to enter the market. Where is the security in the stock market?

On April 2 (U.S. time), President Trump imposed tariffs of 145% on China (with some products going as high as 245%), while China retaliated with tariffs of 125% on the U.S. This has officially escalated the U.S.-China trade war into its second round, causing a deadlock. China has notably shifted from its previously moderate post-pandemic foreign policy, making it harder for U.S. companies that relocated production lines to Vietnam and India.

Despite the booming tech stocks, like TSMC showing strong North American AI technology demand in their April 17 earnings call, the investment environment remains tense with NVIDIA facing a $5.5 billion loss due to restrictions on low-end chip exports to China. Additionally, Trump has postponed tariffs on other countries for 90 days, leading to a cautious stance among factories and potential damage to profits for export-dependent businesses.

In this context, conservative investors might consider lower entry positions in defensive domestic stocks, which are crucial in their markets and maintain relatively stable cash flow and profitability even in economic downturns. Suggested defensive stocks include: Taiwan Tigerair (6757), Da Cheng (1210), CP (1215), and Uni-President (1216).

Investment carries risks; investors should carefully assess risks when making decisions and are responsible for their investment outcomes.