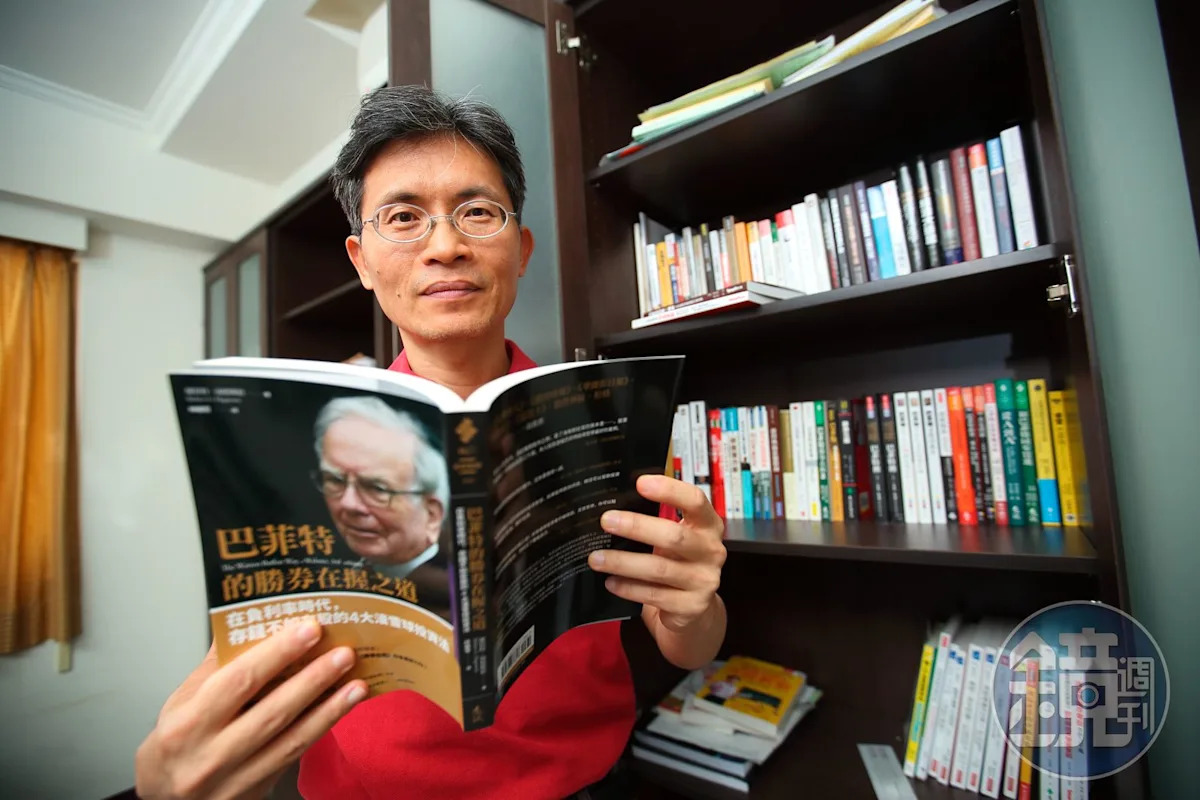

Warren Educator Shifts to Japanese Stock ETFs: Focusing on Two Advantages for Steady Returns

As the stock market thrives, Warren educator decides to follow in Buffett's footsteps and venture into the Japanese market, focusing on leading enterprises with stable profit potential. He emphasizes the importance of diversification in investments, avoiding excessive concentration in single stocks. In an environment of tech stock volatility, Japanese stock ETFs become his new frontier.

Warren educator highlights that Japan's five major trading companies, such as Marubeni, Toyota, and Nintendo, possess a powerful "moat," allowing them to perform excellently in the international market. He particularly appreciates these companies for their active global expansion, considering it a key to future profitability.

Furthermore, he points out that the rise in governance and shareholder return consciousness among Japanese companies, coupled with the depreciation of the yen, has attracted global funds to Japanese stock ETFs. He cites the Fuhua Japan Leading ETF (00949) as an example, noting that its holdings include many promising companies that hold dominant positions domestically and perform well internationally.

"The reason I invest in ETFs is that they cover diverse industries and diversify risks, allowing me to invest confidently in a fluctuating market," mentions the Warren educator.