Taiwan Stocks Set to Challenge 23,000 Points Amid Earnings Season

The earnings season is expected to drive Taiwan stocks upward as they approach the 23,000-point mark. Recent progress in China-US trade negotiations has alleviated market concerns, making the upcoming month-end earning reports from institutional investors and corporations highly anticipated.

Market experts indicate that group earnings activities in early June, combined with company annual meetings, will strongly influence stock performance, followed by institutional investments taking the lead later in June. With active funds favoring small and mid-cap stocks, potential for catch-up moves looks promising. As long as geopolitical tensions do not escalate, Taiwan stocks may challenge the significant 23,000-point mark.

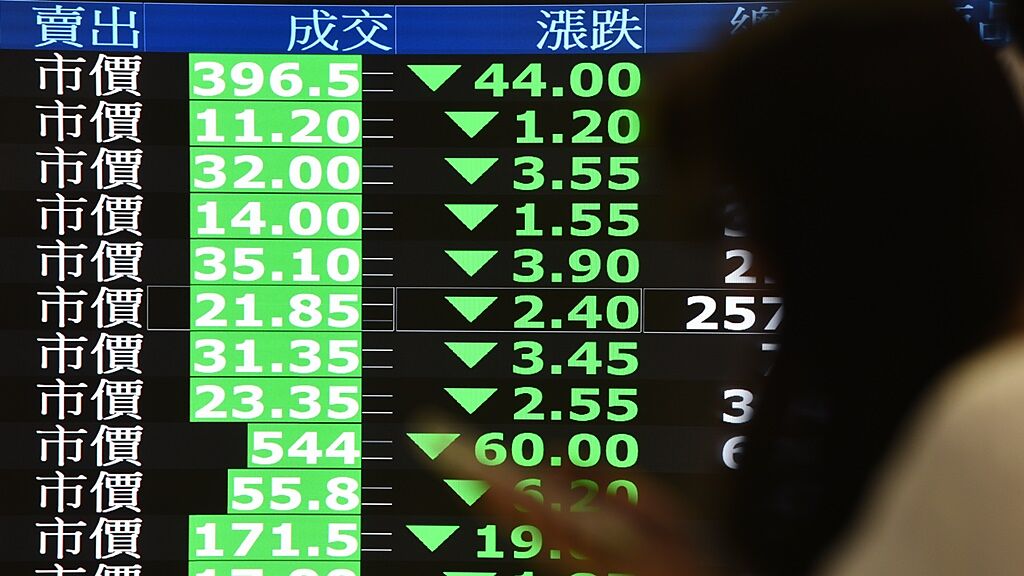

Last week, the Taiwan stock index hit a high of 22,470 points after overcoming the shock of the April stock market crash, reclaiming all moving averages for the first time in two months, although profit-taking pressure has emerged since. Analysts noted that after rebounding nearly 30% from the early April low of 17,306 points to the recent high, a short-term pullback is probable, but is expected to find support around 21,677 points, paves the way for a further attempt at 23,000 points before the end of the month.

Looking ahead, Huang Wenqing, Deputy General Manager of Taixin Investment Advisory, believes there is still room for upward movement, but market funds may shift from large-cap stocks to thematic small and mid-cap stocks, driven mainly by earnings activities at the end of the quarter. Statistics show that institutional investors have purchased a net total of NT$210.993 billion in Taiwan stocks this year, with an intensified buying force in May and June, accumulating NT$80.554 billion in total during these two months.

According to Chen Yiguang, Chairman of Fubon Investment Advisory, the earnings season will begin in early June, led by group activities, which are expected to synergize with annual shareholder meetings. He emphasized the necessity to focus on small and mid-cap stock selections, ensuring investors are prepared to capitalize on the resulting opportunities.