High Dividend ETF Offers Over 6% Cash Dividend, Resilient Against Trump Tariffs

The domestic high dividend ETF is not affected by exchange rates, and most can enjoy cash dividend yields of over 5 to 6%, making them more attractive than U.S. Treasury bonds. The tariff issue disrupts global stock markets, and although the Taiwanese market has been strongly consolidating since the stock crash in April, the market sentiment remains relatively conservative, with short-term profit-taking selling pressure emerging. In this uncertain environment, rather than letting funds sit idle, it is better to generate cash flow through high dividend ETFs.

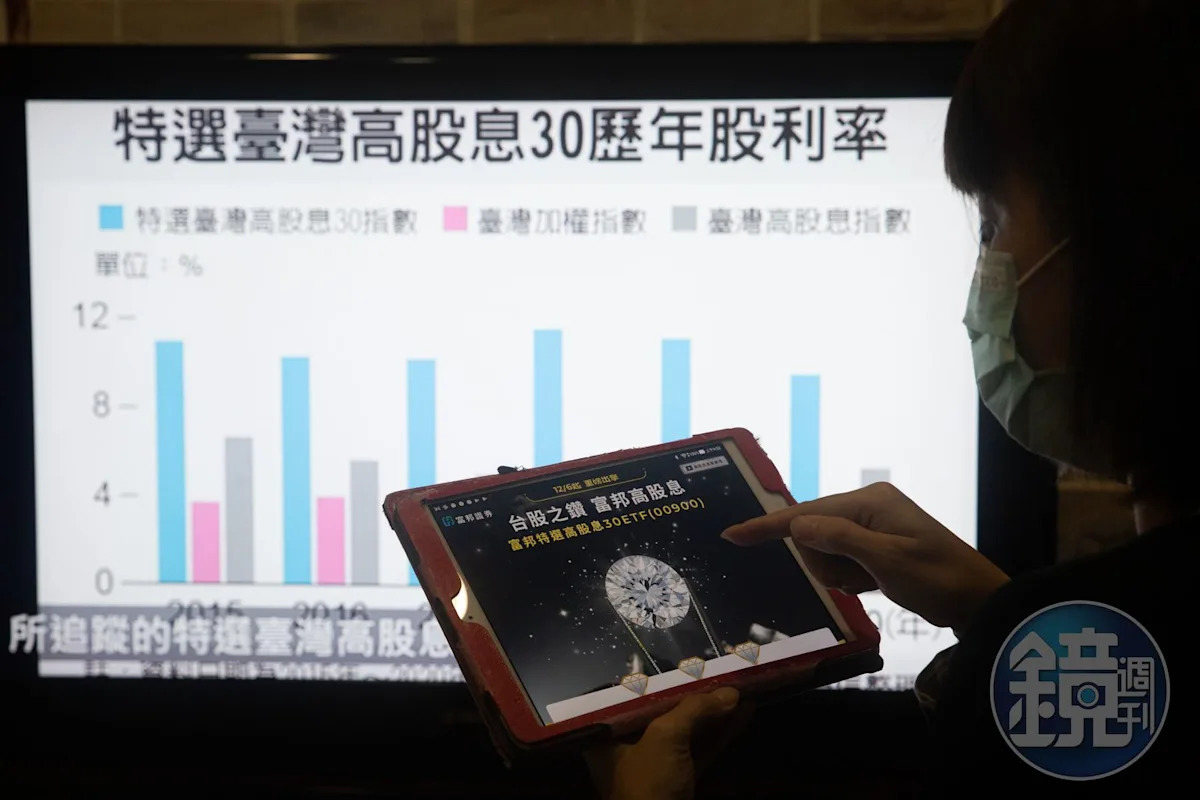

According to investment strategist Xu Yida from Fubon Investment Trust, the average cash dividend yield of the Taiwanese stock market is expected to be about 2.5% in 2024, with an estimated 15 to 20% growth in corporate profits this year, presenting an opportunity for an increase in the dividend payout ratio. While the current yield of the high dividend ETF cannot be compared to the peak times of 2022 and 2023, achieving yields of 5 to 6% remains a reasonable level. The uncertainties surrounding Trump’s tariffs pose a significant risk to investors.

Xu points out that corporate profit performance will become clearer by the end of the year, and the second quarter is expected to witness a strong demand due to a 90-day postponement of the tariff equalization, benefiting the retail sector in maintaining high inventory levels. When selecting high dividend ETFs, investors should consider two key focuses: the trend of a strong New Taiwan dollar and uncertainties around tariffs.

Investors need to be cautious of potential risks related to high dividend ETFs, especially regarding how dividend returns may be affected by tariff policies. Xu emphasizes that it is crucial to focus on domestic demand sectors that benefit from exchange rate fluctuations, while stable stocks are preferable. For example, the 00900 (Fubon Selected High Dividend 30) ETF follows a strategy that rotates its holdings three times a year to maximize participation in dividends while diversifying risks.