US Futures Market Closed for Memorial Day, Gold Futures Slide

The US futures market was closed on May 26 for Memorial Day, causing the latest quote for June gold futures on the New York Mercantile Exchange (COMEX) to drop by $23.6 to $3,342.2 per ounce. President Trump announced after a call with European Commission President Ursula von der Leyen that the deadline for the 50% tariffs on the EU would be extended to July 9, easing market tensions from last Friday's threats to impose tariffs starting June 1.

Thorsten Polleit, an honorary professor of economics at the University of Bayreuth, expressed that he cannot rule out further pullbacks in gold prices. However, as US government debt rises, more investors will likely turn to gold for value and safety. He noted that the gold market is currently in a tug-of-war between growing concerns over an impending recession and the resilience of the US economy and labor market. He stated that if the economy were to improve in the short term or a new trade agreement were announced, gold prices could fall back to $3,000 per ounce.

Despite this, Polleit suggests that any short-term price drop should be seen as a buying opportunity, as gold still possesses strong long-term upward potential. He also pointed out that as investor confidence in US treasuries weakens due to unsustainable debt levels, gold prices may rise further. Polleit expects central banks to continue buying gold in the current environment. FXTM's chief market analyst Han Tan stated, "As long as US treasury yields do not spike dramatically and 30-year yields remain around 5%, the upward momentum for gold may slow. This week, the gold market will adjust its expectations for rate cuts based on signals from the Fed's meeting minutes, officials' speeches, and PCE data, alongside trade and geopolitical developments."

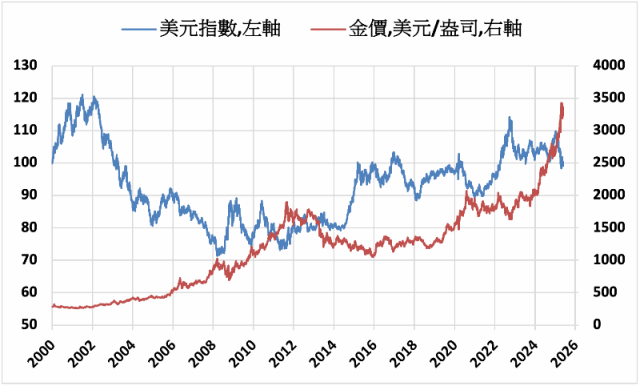

LPL Financial's chief technical strategist Adam Turnquist reported that the weakening dollar may push gold prices higher. He noted that the dollar has struggled for support over the past month, and the trend of dedollarization continues, with rising deficit expectations and a downgrade of US credit rating putting pressure on the dollar. Senior market analyst David Morrison of Trade Nation mentioned that a weak dollar would continue to be bullish for gold, although price trends may develop in both directions. He added, "In light of a weakening dollar, concerns about excessive US debt have led investors to avoid the treasury market, making gold an attractive safe-haven investment."

According to a weekly gold survey, analysts expect gold prices to rise this week, with 81% forecasting gains while none predicted a decrease.