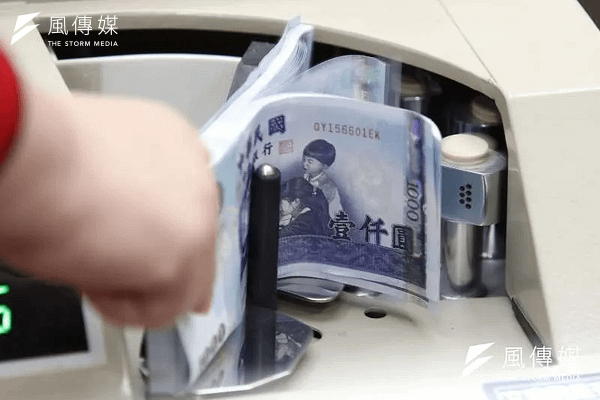

Hua Nan Bank's High-Net-Worth Clients Hold NT$97.7 Billion, Robo-Advisory Market Share Nears 15%

Despite being a traditional bank, Hua Nan Bank has reported its high-net-worth clients have deposits totaling NT$97.7 billion. Although robo-advisory services are not highly regarded among Taiwan's traditional banks, they manage assets amounting to NT$1.9 billion.

Hua Nan Financial Holding (2880) held a investor conference on the 27th, revealing its operational performance for Q1 2025, and indicating robust overall operations. The core subsidiary, Hua Nan Bank, continues to grow its profits, although the performance of its securities and insurance subsidiaries has been impacted by fluctuations in the capital market. For Q1 2025, the financial holding company reported a net profit of NT$5.338 billion, a 5.2% year-on-year decrease, with earnings per share (EPS) of NT$0.39, an annualized return on equity (ROE) of 9.47%, and a return on assets (ROA) of 0.51%.

For Q1 2025, Hua Nan Bank's net profit after tax was NT$5.209 billion, demonstrating a 3.3% year-on-year increase, with an EPS of NT$0.50, an annualized ROE of 8.49%, and an annualized ROA of 0.51%. The bank's high-net-worth clients have reached 985, with total assets under management (AUM) exceeding NT$97.7 billion, and they are planning to integrate a specialist team to offer tailored financial planning services.

In the securities sector, Hua Nan Yongchang Securities saw its net profit drop by over 50% to NT$215 million in Q1 due to a struggling stock market. Hua Nan Insurance reported the highest quarterly premium income of NT$4.259 billion and has launched diverse insurance products tailored to market demands. As digital transformation progresses, Hua Nan Bank is also optimizing its digital channels to enhance customer satisfaction.