Taiwan's Stock Market Surges Past 20,000 Points Amidst Uncertain Policies

According to reports from Taipei, President Trump's erratic policies have led investors to sell U.S. assets, causing the American stock market to lag behind other regions in the first 16 weeks of this year. Analysts suggest that Trump's tariff policies are influencing inflation expectations in the U.S., causing some momentum to shift toward European stocks. However, the U.S. market has recently rebounded strongly, boosting the performance of Taiwan's stocks, though investors are still advised to remain cautious due to the uncertain situation.

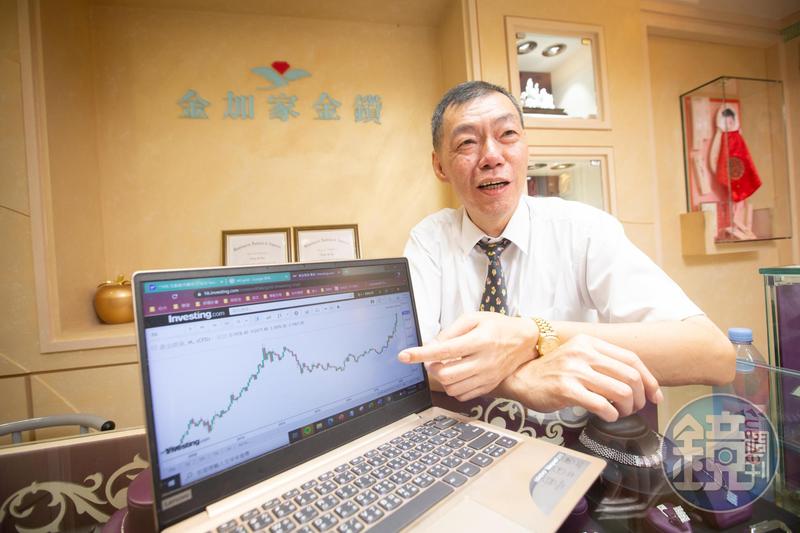

Reporters note that on Monday, Taiwan's stock market began with a strong performance, momentarily stabilizing above the 20,000-point mark, and rising over 200 points. The market opened at 19,972 points and continued to climb, returning above the 20,000 threshold, with TSMC's opening price rising by 10 dollars to 898 dollars, leading the rally. Li Yongnian, Deputy General Manager of an investment advisory firm, stated that the main reason was due to the U.S. market rebounding for a fourth consecutive day last Friday, alongside strong performance from TSMC and related electronics futures.

While the market is optimistic about short-term performance, long-term outlooks remain cautious. Even though tech earnings are boosting confidence, the MSCI U.S. index has fallen by 11% in the first 16 weeks of this year, which is an important benchmark for investors and analysts, affecting future prospects. Lin Ruyi, another deputy general manager, mentioned that following tariffs, capital is expected to start moving from U.S. stocks to European ones, and the fluctuations in Taiwan's stocks are likely to align with those in the U.S. Financial Times pointed out that Trump’s uncertain policies have prompted investors to offload U.S. assets, resulting in a significant performance gap between U.S. stocks and other regions, the largest in 32 years. Analysts also warn that while the market appears to be bullish, investors should not get complacent, especially given the uncertainties surrounding U.S. tariff policies.