As Rate Cuts Draw Near, Yield Curve Inversion May End, Unveiling Four Key Spread Trading Opportunities

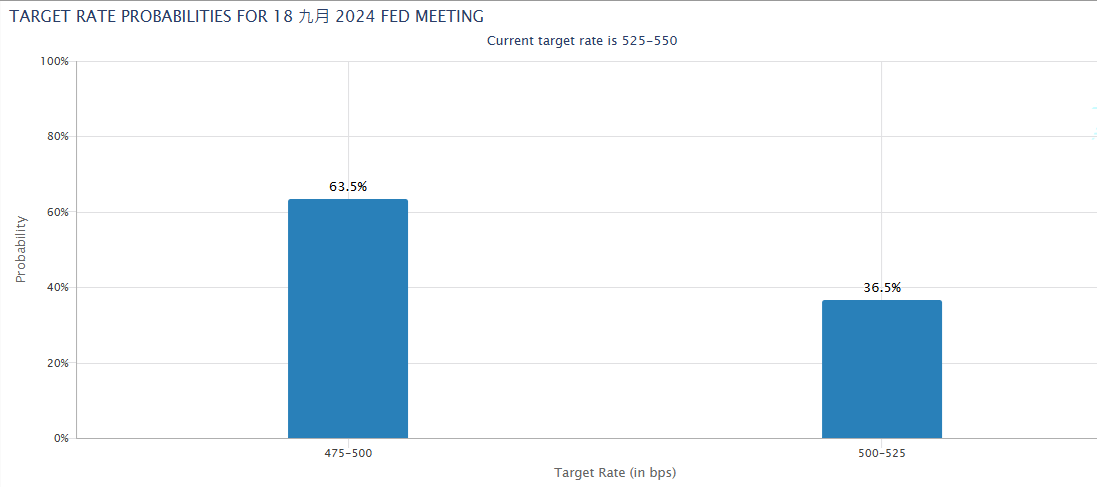

The Federal Reserve has become more optimistic about the outlook for inflation to ease, with Chairman Powell indicating after the July meeting that a high-interest environment is nearing its end. Market expectations suggest that a rate cut is possible in September, with a 36.5% chance of a single cut and a 63.5% chance of two cuts, leading to quick reactions in the stock, foreign exchange, and bond markets.

In contrast to the significant volatility in the stock market and the rapid retreat of the dollar index, the US Treasury market has finally experienced an optimistic rally driven by rate cut expectations. Notably, the yield on the 2-year Treasury bond dipped to 3.66% on August 5, marking a new low since April 2023. This temporarily ended a long-standing yield curve inversion, although the inversion quickly returned, creating investor anticipation for new trends.

Yield curve inversion generally occurs when short-term rates exceed long-term rates, reflecting market pessimism about future economic conditions. Historically, the difference in yields between the 10-year and 2-year Treasury bonds indicates that long-term rates should typically be higher than short-term rates. The inversion may signal heightened risks of economic recession, hence creating opportunities for spread trades.

Spread trading allows investors to exploit abnormal trends between highly correlated assets. For example, with the rapid decline in the yield of the 2-year Treasury bond, four primary trading patterns emerge: First, buying both 2-year and 10-year Treasury bonds when their yields decline; second, a more aggressive scenario where the yield on the 2-year bond falls while the 10-year bond rises, prompting investors to sell the 10-year bond; third, if the 2-year bond yield rebounds while the 10-year bond remains low, the strategy involves shorting the 2-year bond while buying the 10-year bond; fourth, in a case where the inversion broadens again, such as when rate cut expectations are removed, leading the 2-year yield to rise sharply, both bonds would be sold. Interested investors can refer to CME's educational videos to learn more about executing these strategies.