Dollar Remains Resilient, Can Euro, Yen, and Pound Stage a Comeback?

By Li Qi-zhan

The recent June U.S. interest rate decision has significantly impacted the financial markets. Despite adverse inflation data, the dollar maintains a strong yet volatile position. The question remains whether it can strengthen further. Among major non-U.S. currencies, which ones have a chance against the dollar?

First, let's examine the economic data from the U.S. The CPI for May showed a 0% month-over-month change and a 3.3% year-over-year increase, both slightly below expectations. This led the dollar to test lower levels before the interest rate decision was announced. The announcement to maintain rates with a commitment to not lower them in the short term allowed the dollar to rebound.

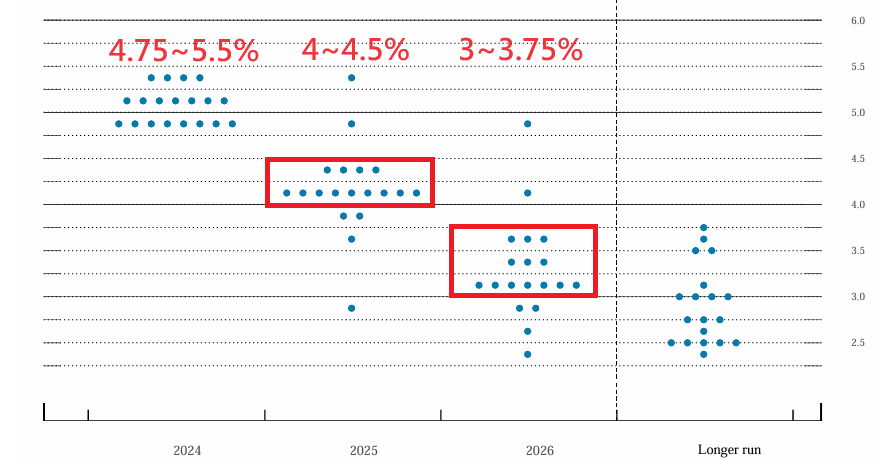

The Federal Reserve increased its forecast for the year-on-year core PCE inflation rate to 2.8% and raised the median year-end rate to 5.1%. This indicates a less aggressive stance on rate cuts. The dot plot shows a mix of opinions on future rate directions, with some members advocating for a one or two-rate cut. However, the overall trend suggests a gradual path ahead.

For the euro, the interplay of rate cuts and rising inflation expectations creates uncertainties that can impact future rate movements. If inflation rises and technical resistance is broken, market sentiment may shift.

In comparison, the Bank of Japan is under pressure from weak yen performance, planning further rate hikes. Volatility could increase if the yen stays weak. The UK faces downward pressure on CPI year-over-year, increasing expectations for rate cuts. Latest data reflects that CME set a new record for forex futures trading volumes in June, indicating growing investor acceptance of forex futures.