Risks of US Debt Default Rise, Experts Warn: Potential Global Financial Crisis

[FTNN News] Reporter Feng Haolun / Comprehensive Report - The US's equal tariffs have caused market turmoil, creating uncertainty among investors. With the US government facing $6.5 trillion in bonds maturing in June, the expert group 'Stockholding Equation' issued a warning on Facebook, stating that if US bonds defaulted, it could lead to a 'catastrophic crash' in the financial market.

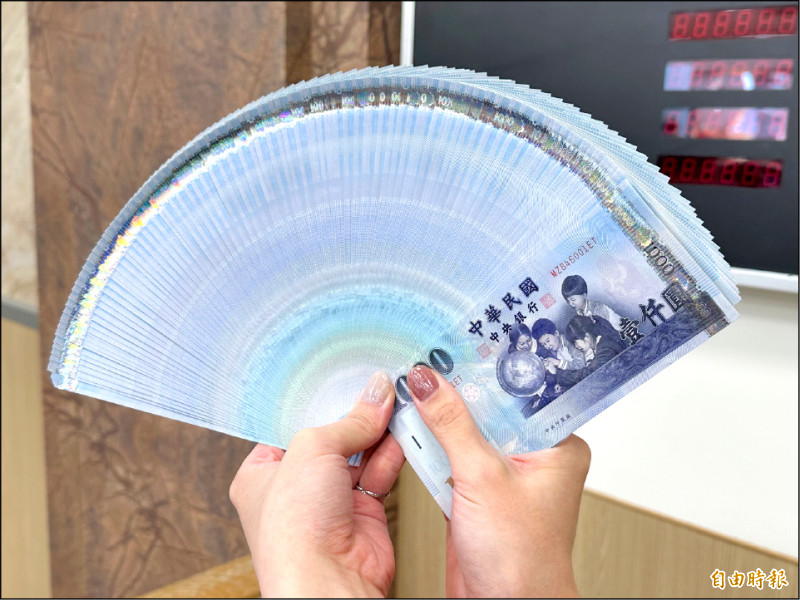

The 'Stockholding Equation' warned that if US bonds defaulted, it would send a shockwave across the global market, possibly triggering a financial crisis on the scale of the 2008-2009 mortgage crisis. An analysis indicated that the upcoming maturity of $6.5 trillion (approximately NT$211 trillion) in US government bonds is causing skepticism about the government's ability to repay such a massive debt. Long seen as a safe asset, a default on US bonds would have severe consequences, with the dollar likely depreciating rapidly and stock markets facing unprecedented sell-offs.

Experts stated that while the US government has various strategies to manage its debts, the situation remains precarious. With the national debt reaching $36 trillion, the risk of default is increasing. As the possibility of debt default looms, market participants suggest that investors should consider selling some of their holdings to mitigate risks.