Gold Investor Recommends Entry Below $1918 as Prices Consolidate

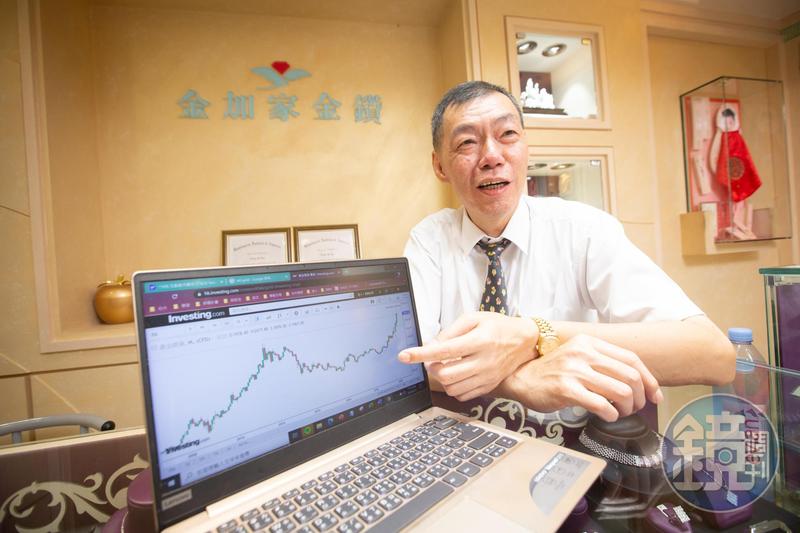

Despite the current consolidation of gold prices, investor Shih Wen-Hsin boldly suggests entering the market when gold drops below $1918. He emphasizes the irresistible allure of gold as a store of value and hedge, especially during the ongoing pandemic that has driven prices upward. However, he insists that investing in gold is not just a short-term strategy.

Having started holding gold at $280 per ounce, he has witnessed the price rise past $1000 and even $2000. Shih mentions that the fluctuations of gold prices typically have a cyclical nature, with substantial waves occurring roughly every ten years. He predicts that we are nearing the end of this ten-year consolidation phase.

This year, driven by pandemic-related safe-haven demand, the spot price of gold surged to as high as $2057 an ounce in early August, breaking its previous record. Shih reinforces his belief that entering below previous high points provides opportunities for profit, although the timing varies.

Additionally, even Warren Buffett, who traditionally avoids gold investments, has changed his approach by purchasing shares in Barrick Gold. Shih admits he avoids stocks, relying instead on physical gold and gold futures for building wealth.

Operating with short-term strategies and using three indicators to gauge the bullish and bearish trends of gold prices, he adjusts his approach frequently due to uncertainties caused by the pandemic.