Dow Jones Index Drops 1.79% Amid Concerns Over Middle East Conflict

The US stock market fell on Friday due to concerns over the ongoing conflict in the Middle East. Adam Crisafulli, founder of Vital Knowledge, stated that the market's reaction was anticipated, including rising oil prices and falling stocks, though he believes that overall market sentiment remains relatively calm, largely depending on the situation in the Middle East and recent OPEC+ production increase decisions.

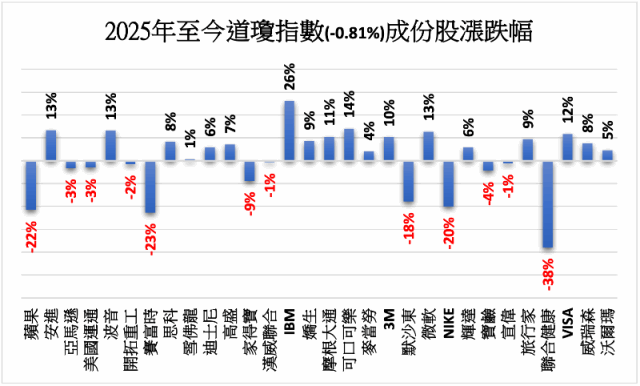

As of June 13, the Dow Jones Industrial Average dropped by 1.79% (769.83 points) to end at 42,197.79 points. The S&P 500 index fell by 1.13% (68.29 points) to 5,976.97 points, while the Nasdaq index declined by 1.30% (255.66 points) to close at 19,406.83 points. The Philadelphia Semiconductor Index fell by 2.61% (136.91 points) to 5,112.24 points.

Among the top five components of the Dow, Goldman Sachs (weight 8.94%) fell by 1.85%, Microsoft (weight 6.85%) dropped by 0.82%, Visa Inc. (weight 5.31%) decreased by 4.99%, Home Depot (weight 5.20%) went down by 2.34%, and Caterpillar (weight 5.16%) fell by 1.08%. Ed Yardeni, founder of Yardeni Research, remains optimistic about the market's rebound prospects over the next six months, predicting that the S&P 500 may rise to 6,500 points by the end of the year.

Yardeni commented that the market would respond preemptively regarding tariff issues, noting a positive long-term outlook despite concerns over supply chain risks and overheated AI investments. The rare earth metals mentioned recently are key resources in the modern economy and could severely impact the tech and manufacturing sectors if geopolitical or trade tensions lead to supply disruptions.

Daniel Skelly, head of market research and strategy at Morgan Stanley Wealth Management, reported that the S&P 500 may struggle to sustain its rebound from the April lows given the geopolitical risks and the Federal Reserve's reluctance to cut interest rates. However, the situation differs at the industry and individual stock levels, with industrial stocks making a comeback to historical highs driven by AI infrastructure spending and potential manufacturing trends.

Moreover, defensive stocks in sectors such as healthcare and consumer goods may perform better than cyclical stocks in the next three to four months due to lower tariff risks. The latest data from Bank of America indicated significant outflows from US stock funds, marking the largest scale of withdrawals in the last three months, with approximately $9.8 billion redeemed in the week ending June 11.