Taiwan 50 ETF Split Raises Attention, with Firms Highlighting Accessibility Without Splitting

The flagship ETF, Yuanta Taiwan 50 ETF (0050), is planning a "1-for-4" stock split, set to pause trading from June 11 to June 17 for 5 business days, resuming on June 18. This move has generated significant focus on the trend of "affordable" ETFs in the Taiwanese market.

Industry experts emphasize that while stock splits can enhance liquidity and willingness to participate, for long-term investors, the index design and risk management behind the ETF are critical to ensuring stable returns.

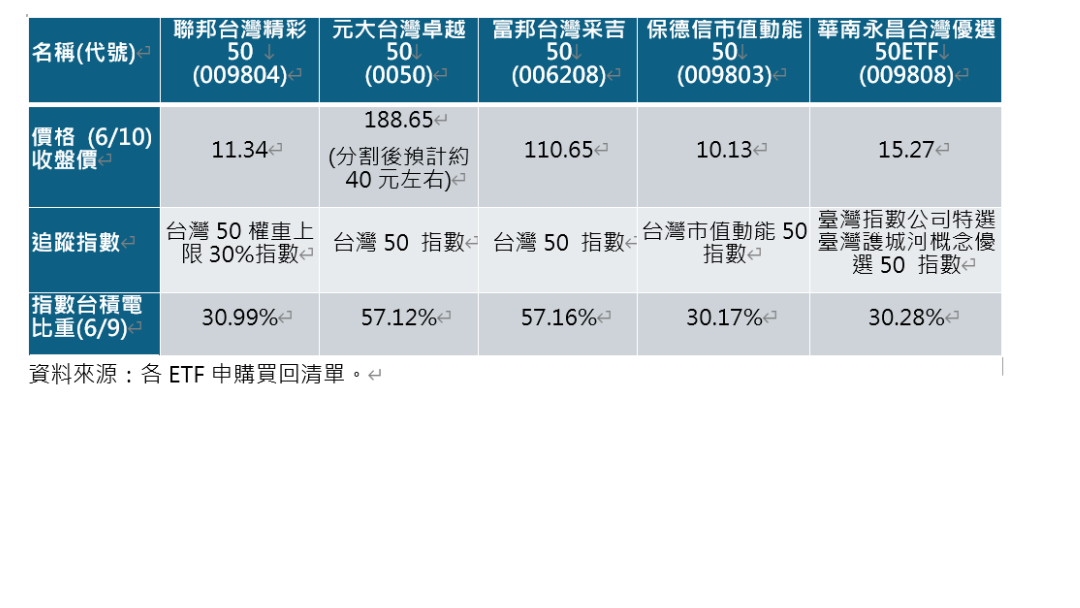

Currently, there are five major market cap ETFs: Yuanta Taiwan Excellence 50 (0050), Fubon Taiwan Selected 50 (006208), Prudential Market Momentum 50 (009803), Union Taiwan Wonderful 50 (009804), and Hua Nan Yong Chang Taiwan Selected 50 (009808). All of these ETFs track market-cap-centric indices but differ significantly in design logic and individual stock weights.

0050 and 006208 are the first issued market cap ETFs, both tracking the Taiwan 50 Index, which includes the largest 50 companies by market capitalization, making them highly representative of the market. According to experts, they faithfully reflect market structure in their index design, resulting in TSMC comprising nearly 60% of their portfolio. For those bullish on TSMC, these ETFs remain popular choices for aggressive investors.

009803 employs a dual-factor selection approach based on market capitalization and price momentum, emphasizing flexibility and short to medium-term performance potential. This type of strategic ETF is suitable for investors seeking performance opportunities, but may experience more volatility during market turbulence.

009808 has a design logic similar to traditional market cap ETFs but incorporates certain selection mechanisms to optimize, resulting in a slightly lower concentration of weights compared to 0050, while still focusing primarily on large-cap stocks. Notably, 009804 features a design that emphasizes "balance" and "affordability." It tracks the same constituent stocks as the Taiwan 50 Index but incorporates a 30% cap on individual stock weights, reducing the proportion of large-cap stocks like TSMC and leading to a more even distribution that mitigates concentration risk.

Industry professionals point out that 009804 offers accessibility through its existing structure without needing a stock split, and its constituent stocks are identical to those in 0050 and 006208. Furthermore, 009804 features a semi-annual dividend system, making it an appealing option for steady investors and smaller investors who want to participate in core Taiwanese equities while also being mindful of price thresholds and volatility risk.