Trump's Tariff Threat Leads to a Full Decline in CBOT Agricultural Commodities

The Chicago Board of Trade (CBOT) experienced a total decline in its three major agricultural commodity futures on May 23, due to Trump's renewed threat of imposing a 50% tariff on European imports, triggering market concerns. The July corn futures closed down 0.8% at $4.5950 per bushel, July wheat down 0.4% at $5.4250 per bushel, and July soybeans down 0.7% at $10.6025 per bushel.

Last week, soybeans, wheat, and corn increased by 1%, 3.3%, and 3.6% respectively. Additionally, US Intercontinental Exchange (ICE Futures U.S.) reported that July cotton futures rose 0.7% to 66.11 cents per pound on May 23, a weekly increase of 1.9%. In contrast, July raw sugar futures declined 0.6% to 17.29 cents per pound, a weekly decline of 1.3%.

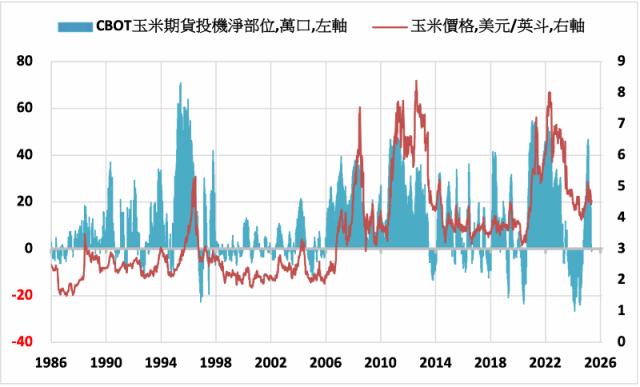

According to the US Commodity Futures Trading Commission's report on May 23, as of May 20, the speculative net short position in Chicago wheat futures held by fund managers (mainly hedge funds) and other large traders decreased by 16% to 99,626 contracts. The speculative net position for corn flipped from long to short at -11,552 contracts, marking an eight-month low. The speculative net long position for soybeans decreased by 26% to 47,913 contracts.